| Author |

Replies: 24 / Views: 2,873 Replies: 24 / Views: 2,873 |

Page 2 of 2

|

|

|

|

Moderator

United States

171012 Posts |

Quote:Quote:

Silver certainly seems well overdue for a run-up. Speaking of the devil..... How high will it fly?

|

|

Pillar of the Community

United States

632 Posts |

Silver was about $32 when I posted this and today it closed at $44.23 while on a meteoric rise. So I guess my "gut feeling" was right but I do remember so many in my forums saying "hold off, its going to back off" and with some sound reasoning behind it $32 for an oz of silver back then was a lot of money but the ratio was still about 81 oz for 1 oz of gold.

I believed in $32 silver just like I believe in $44.23 silver and in short order it will be $50. I made some big purchases last May 2nd, in July too. Sometimes you just have to go with the gut.

|

|

Pillar of the Community

United States

7529 Posts |

-makecents-

Edited by -makecents-

09/22/2025 8:58 pm

|

|

Moderator

United States

171012 Posts |

Quote:

I believed in $32 silver just like I believe in $44.23 silver and in short order it will be $50.

|

|

Valued Member

New Zealand

166 Posts |

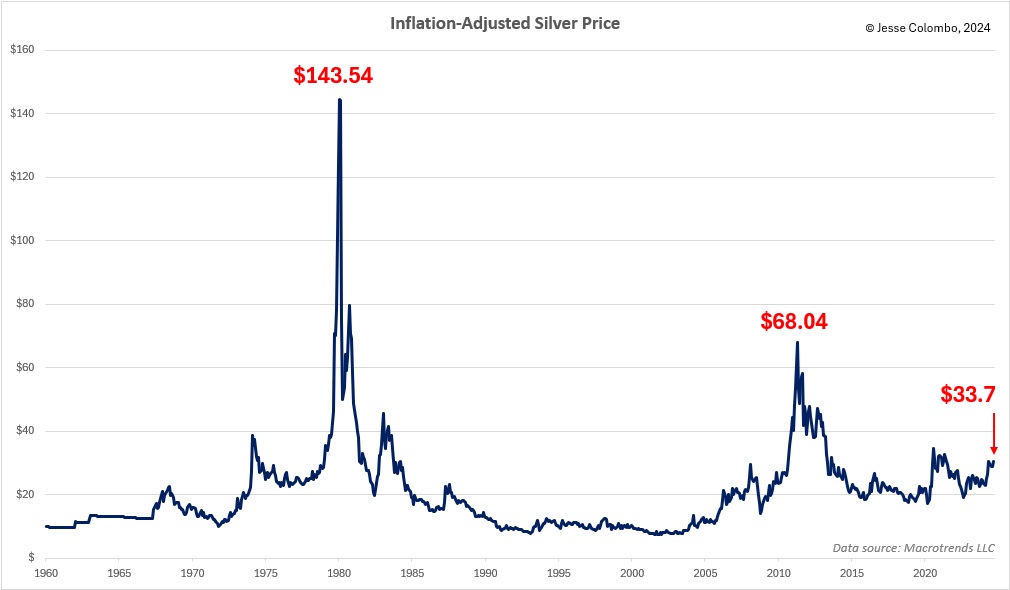

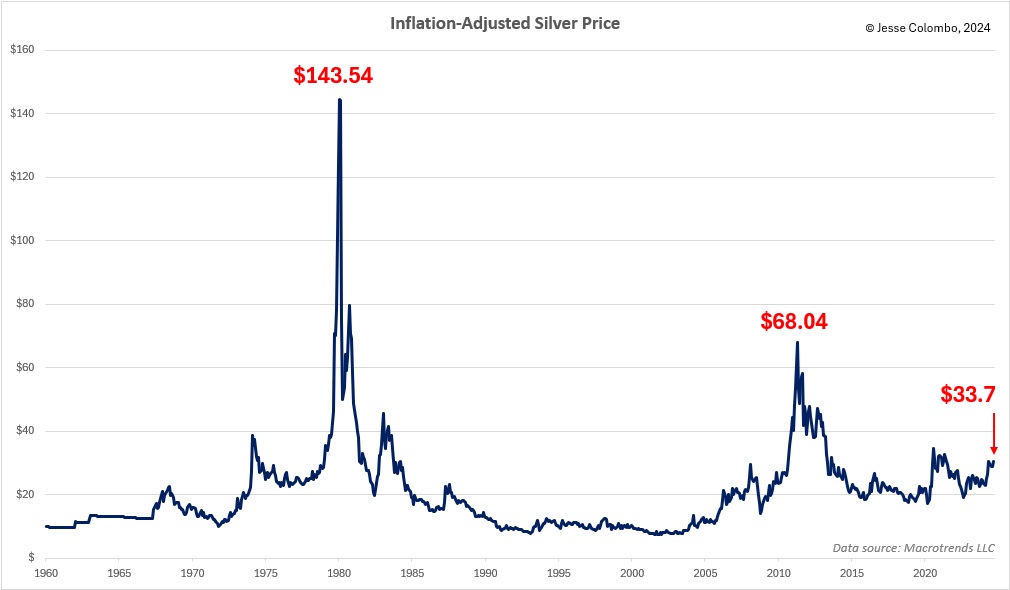

This is dated 2024, but it underscores the point that silver is well below any inflation-adjusted high, though I think we should ignore that highest point from 1980 because it was a result of market manipulation. Maybe the $80 is a more credible number? Still, it's well off its early 21st century high even if it hits $50 this year. Ah, well, time will tell.  Do not read this sentence.

|

|

Moderator

United States

171012 Posts |

Very interesting.  |

|

Bedrock of the Community

Australia

21673 Posts |

Looking at the price chart

I notice that each build up took 3 or 4 years.

then a crash.

At this time, a speculator should become increasingly circumspect when accumulating more bullion.

There will come a time when extra purchases must stop, or big losses will be incurred.

Judgement remains in the hands of the speculator.

---------------------------------------------------------------------------------------------------------------------------------------------------------

For me, none of this matters.

I am a numistmatist coin collector, and so I just ignore the silver price, and thus just sail right through the silver price spikes and troughs.

I have collection of about 7 kilos of numismatic silver, formed over a period of about 50 years. My attitude is similar to that of a museum curator, where the numismatic value and the silver value is of only little interest.

|

|

Valued Member

United Kingdom

361 Posts |

Well said, sel_691. Must admit though, as I collect Maria Theresia Thalers I am aware of silver bullion price changes at the bottom end of the Thaler price range. The rarer specimens are not so sensitive to those changes. The problem, though, is that a lot of the more worn examples get melted when bullion prices go up, and some nice old coins are lost, not to mention the Russians you meet going round coin fairs buying them all up!!!

|

|

Pillar of the Community

United States

632 Posts |

About $32 oz when I started this thread and it looks like my gut feeling was right. Silver has since gone up to over $47.50 and now sits at $46.26 "tho not for long". For a 5 month spread thats not a bad investment grade buy, a $15 oz profit. Especially considering the oz's weight some guys here buy. So if one bought 1,000 oz when I had that gut feeling, which many did I'm sure, right now you'd be sitting on a $15,000 pure profit. For gold, and you remember how we were complaining about $3,200+ gold, you'd be sitting on a profit of $816 per coin. Which BTW I did, and for more profit then that, coming out to $10,000 or there abouts overall profit, and I know there were guys here who bought a hell of a lot more gold and made a hell of a lot more profit then I. So for the average stacker, one who stacks roughly the same weight/profit for silver and they do gold when the going is good, for the 5 mos on this year since Apr/May to now I'd bet most made roughly $10 k to $20 K, at least. Pure profit. I know I bought a crap load of silver last winter/spring. Much of it easy to sell coinage, junk, and 10 oz bars. Nor do I think silver is near to be done yet. I'm still bulllish for 2025 and 2026 and its really not easy with the numismatics I have to put on hold in order to buy weight of the white metal. I just bought 12 ASE's for $45.50 each that now, a few days later, cant be touched for under $49.26 each. A $50 profit in a few days, thank you very much. So making $20 K to $40 K profit on gold/silver is nothing to sneeze at. Were I Michael Jordan I'd have a numismatic collection that could choke an elephant. However the reality is I'm just some poor schlub retiree thats making a few bucks on the metals market and consider $40 K a good profit. And for that matter quality numismatics are going for good prices too. I recently just couldn't pass up a VF, slabbed, seated $1 Liberty for $429 when it was easily, EASILY, worth $200 to $250 more. *** Edited by Staff - Paragraph Inappropriate for here removed *** |

|

Pillar of the Community

United States

2020 Posts |

Respectfully, you are talking paper "pure profits" versus reality when it comes time to sell. The truth is you're not going to get the prices you think you are at these elevated spot levels. Local coin shops have dialed back their buy prices (from 93% to 91% of spot for generics) and they told me refiners have as well ($2 under spot). Also, if you're talking about selling at levels that get you $20k-$40k profits, don't you think there's going to be some paperwork and capital gains involved?

While I am bullish long term like you are, full transparency in what you will net is important. If it were as easy to make the kind of money you are stating, people might think it's a good idea to quit their job and get into metals flipping. The reality is that it's not as simple as looking at your buy price and looking at the spot price and claiming you made pure profit.

|

|

Pillar of the Community

United States

2020 Posts |

I will add one extra layer. Recently, I was at a coin shop when another large coin shop in town called hoping to sell a few hundred Buffalo rounds at 95% to the shop. They laughed and told them 91% just like any other customer. The other shop sent someone over anyway and I am not sure if they made a deal or not, but I heard through the grapevine that so many people were unloading at these high levels that the other shop was having cash flow issues to where they needed to unload immediately (versus waiting for customers to buy or sending the coins to a wholesaler and waiting to get paid).

|

|

Pillar of the Community

United States

632 Posts |

None of this matters because I'm never going to sell. At least while in this world. This is all Legacy investment for after I croak. And I'm leaving plenty of $USD for the wife and kid to float them along with a ton of house equity for them to sell. They can live comfortably anywhere they want without touching the metal. Or at least hurrying to. My wife worked her whole life in commodities so she knows the game. My kid I'm teaching numismatics to and he'll have no need to sell. I'm not an idiot who thinks he can walk into his neighborhood coin shop and come skipping out with current, high spot prices of metal. Heck, I'm not even an idiot who will ever even have to. This is all a financial thought game. Quote:

Respectfully, you are talking paper "pure profits" versus reality when it comes time to sell. The truth is you're not going to get the prices you think you are at these elevated spot levels. Local coin shops have dialed back their buy prices (from 93% to 91% of spot for generics) and they told me refiners have as well ($2 under spot). Also, if you're talking about selling at levels that get you $20k-$40k profits, don't you think there's going to be some paperwork and capital gains involved?

While I am bullish long term like you are, full transparency in what you will net is important. If it were as easy to make the kind of money you are stating, people might think it's a good idea to quit their job and get into metals flipping. The reality is that it's not as simple as looking at your buy price and looking at the spot price and claiming you made pure profit. Edited by Silverskunk

09/30/2025 4:12 pm

|

|

Pillar of the Community

United States

632 Posts |

Quote:

Looking at the price chart

I notice that each build up took 3 or 4 years.

then a crash.

At this time, a speculator should become increasingly circumspect when accumulating more bullion.

There will come a time when extra purchases must stop, or big losses will be incurred.

Judgement remains in the hands of the speculator. This current reality just "feels" different. The difference is, or course, Industrial. Even forgetting all the other Industrial uses our grandkids will live in a world where EV's and Hybrids rule the roads. Theres just no question EV's are the future and the technology needed to catch up to demand. https://chargedevs.com/newswire/sam...ate-battery/And so much new and advanced technology uses a lot of silver with humanity entering an era of high tech. Like a snowball rolling downhill the exponential rate of technical enhancement and innovation is powering an entirely new chapter in silver usage. One thats hard to predict as new technologies emerge faster and faster, other then in fact it will indeed happen. So I can't say where the end game goes. Yes there is the possibility of economic implosion but technology development appears to be a train that just wont derail. Its hard to predict a final high price. Indeed its hard to predict there will even be one, but I know this, we aren't there yet. All the data points of the white metal indicate, growth, increase in usage, and price increases. Heck the market is flush right now and still prices are rising.

Edited by Silverskunk

09/30/2025 4:59 pm

|

|

Pillar of the Community

United States

631 Posts |

Here's an update to my 5/2/25 post....I'm still waiting for that sub $30 settlement to swoop in and make my large purchase. Holding my breath.

|

|

Valued Member

United States

273 Posts |

All my life there has been plenty of silver. Just looking at that long term chart, the vast majority of the time, it is pretty boring punctuated only by brief chaos when COMEX silver tags along a big gold rally. 30% of annual silver production is actual a by product while digging up more important stuff. I have a sterling silver set I bought long ago plus a bunch of scrap that I am going to sell but haven't figured out the best way yet.

|

|

Page 2 of 2

|

Replies: 24 / Views: 2,873 Replies: 24 / Views: 2,873 |

Page 2 of 2

|