| Author |

Replies: 24 / Views: 2,872 Replies: 24 / Views: 2,872 |

|

Pillar of the Community

United States

632 Posts |

Go ahead and quote me on this. The time to buy silver is now. I dont think its ever going to get much cheaper and stacking is pretty easy right now.

The heck with budgets. I'm going to order more.

|

|

|

|

Moderator

United States

171010 Posts |

Sounds plausible.   |

|

Valued Member

Canada

122 Posts |

|

|

Pillar of the Community

United States

631 Posts |

I'm waiting for it to get brlow $30 as it did briefly when the tariff hit the fan. At whichbpoint I will make a major purchase snd subsequently the spot price will undoubtedly sink like the proverbial stone.

|

|

Pillar of the Community

United States

632 Posts |

It would appear every indicator points to the price only going up. Of course I'm no expert but I'm pretty good at spotting trends in history and we are enterring an era in history where technology will more and more be a part of our lives. And silver is used extensively in technology and Industry along with other primary uses such as jewelry, silverware, coinage....ect

But it is in evolving car battery tech where silvers future really shines. And if car batterys are developed and lithium is replaced then why not every other battery for other devices. We've spoken of this before, silver, silver alloys, and electronics go hand in hand. I worked for a metal recycling place and they had great enthusiasm for silver and silver alloys. They wanted it ; They wanted a lot of it. On the other hand Lithium is a terrible metal to extract and most American mines have closed since the end of the Cold War due to environmental concerns. I do know lithium is extremely important for the development of nuclear weapons. Lithium is difficult and expensive to recycle which is why lead acid batterys are still around.

Silver on the other hand is highly recyclable. The mining of it is often accompanied by copper and gold extraction making it an even more viable PM to invest in its extraction. I assume it also has environmental concerns, off hand I cant say how many but I doubt its as dirty as lithium mining. The important thing is its easy and affordable to recycle. Its also a very important metal to have around in order to convert sunlight into energy, which will only grow in importance in the next era of technology. The use of fossil fuels simply is not sustainable.

So I'm bullish on the long term investment security of a silver stack. I think prices now are cheap when compared to coming years. Like the way it retains energy in batterys I think it will retain investment value.

|

|

Valued Member

New Zealand

166 Posts |

Silver certainly seems well overdue for a run-up. I've been kind of mystified as to why it has not moved more with gold going through the roof, and I think the movement on gold is at least partly an overreaction/panic response.

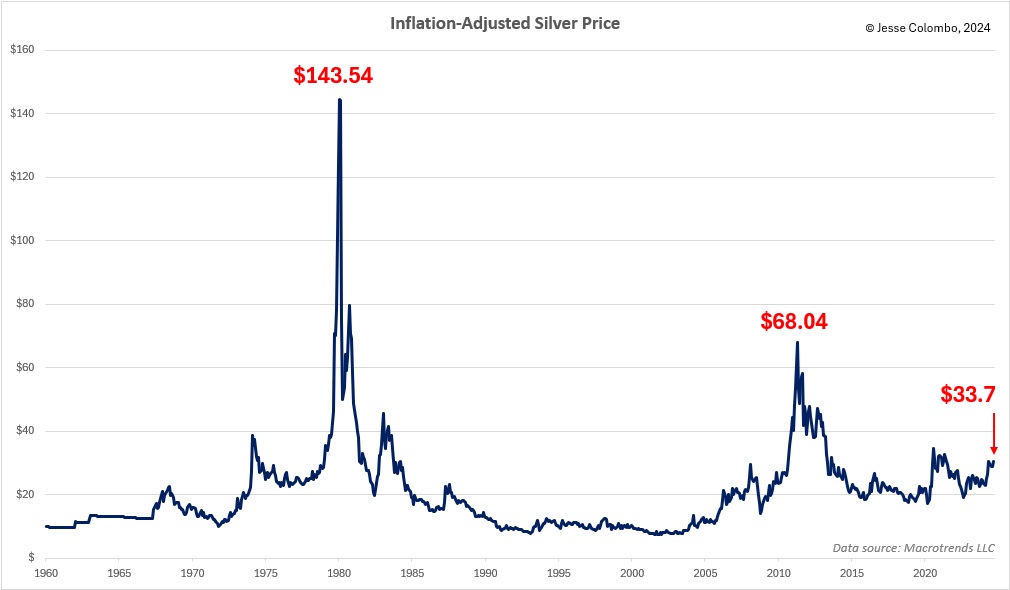

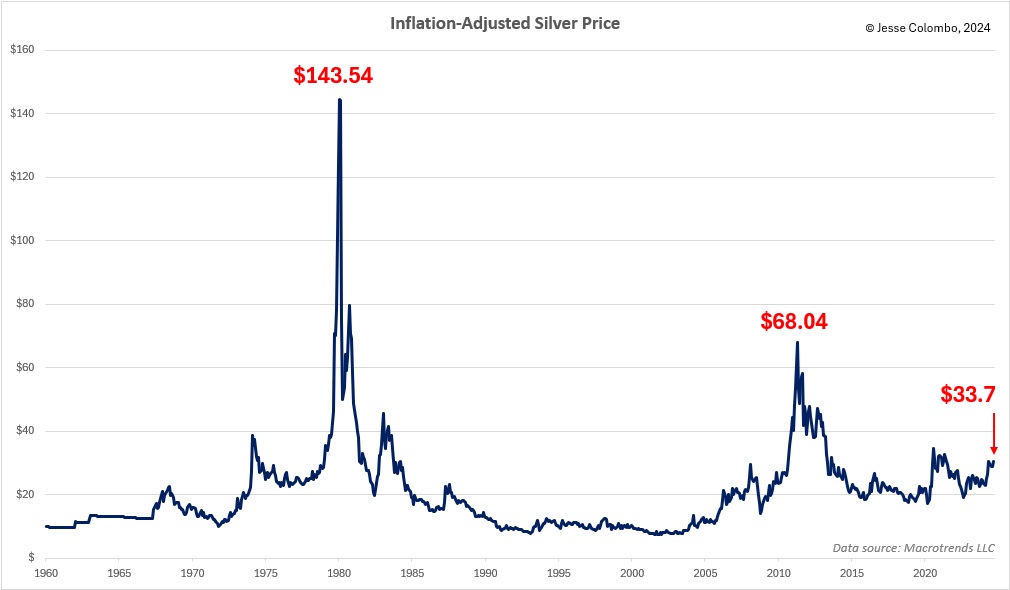

ETA: I would not be using the Hunt Brothers high point as a bench mark for silver values as that was an artificial run-up as a result of their heavily manipulating the market. Would it have gone up somewhat anyway? Maybe. But for safety's sake I'd sooner use the high point in 2011 when it got up to U$56 adjusted for inflation. Could that still be undervalued? Possibly. It's certainly undervalued relative to gold at the moment.

Do not read this sentence.

Edited by Buffalo soldat

05/03/2025 11:36 pm

|

|

Valued Member

Canada

122 Posts |

Costco ,central banks and massive shipments to the US since Christmas has sure helped gold . The general public has not kicked in yet from what I hear. Silver has been in a supply deficit for four years now and its uses are expanding like batteries, solar, medical and electrical . I think its only a matter of time before it takes off. Everything else has moved up due to inflation and silver is below its all time highs (Hunt brothers).

|

|

Pillar of the Community

United States

2597 Posts |

I agree & have been wanting to buy more too. I'll probably get some bars (10oz) or if I can find deals (morgan culls, pre 65 coins) pretty soon.

|

|

Bedrock of the Community

Australia

21673 Posts |

I have only ever bought scrap silver coins at below ASW bullion price, but I also tend to shy away when there is an upward spike in the price that is above the general trend line.

As such, my buying opportunities are few, but that has been my strategy for the last 40 years.

Haven't sold any of them, but I do remember a time when spot silver was below $5 per ounce.

Tend to do the same with numismatic coins generally, especially ancients. Lots of prior price research required, before deciding on a purchase.

|

|

Valued Member

New Zealand

166 Posts |

Quote:

Silver certainly seems well overdue for a run-up. Speaking of the devil..... How high will it fly?

Do not read this sentence.

|

|

Moderator

United States

171010 Posts |

Quote:Quote:

Silver certainly seems well overdue for a run-up. Speaking of the devil..... How high will it fly?

|

|

Pillar of the Community

United States

632 Posts |

Silver was about $32 when I posted this and today it closed at $44.23 while on a meteoric rise. So I guess my "gut feeling" was right but I do remember so many in my forums saying "hold off, its going to back off" and with some sound reasoning behind it $32 for an oz of silver back then was a lot of money but the ratio was still about 81 oz for 1 oz of gold.

I believed in $32 silver just like I believe in $44.23 silver and in short order it will be $50. I made some big purchases last May 2nd, in July too. Sometimes you just have to go with the gut.

|

|

Pillar of the Community

United States

7529 Posts |

-makecents-

Edited by -makecents-

09/22/2025 8:58 pm

|

|

Moderator

United States

171010 Posts |

Quote:

I believed in $32 silver just like I believe in $44.23 silver and in short order it will be $50.

|

|

Valued Member

New Zealand

166 Posts |

This is dated 2024, but it underscores the point that silver is well below any inflation-adjusted high, though I think we should ignore that highest point from 1980 because it was a result of market manipulation. Maybe the $80 is a more credible number? Still, it's well off its early 21st century high even if it hits $50 this year. Ah, well, time will tell.  Do not read this sentence.

|

|

Moderator

United States

171010 Posts |

Very interesting.  |

| |

Replies: 24 / Views: 2,872 Replies: 24 / Views: 2,872 |